In this month’s update, we provide a snapshot of economic occurrences both nationally and from around the globe.

Key points:

– How far will the Fed go in raising official interest rates?

– Russia on the back foot economically as sanctions bite

– Australia jobs data still strong and unemployment remains below 4.0%

The Big Picture

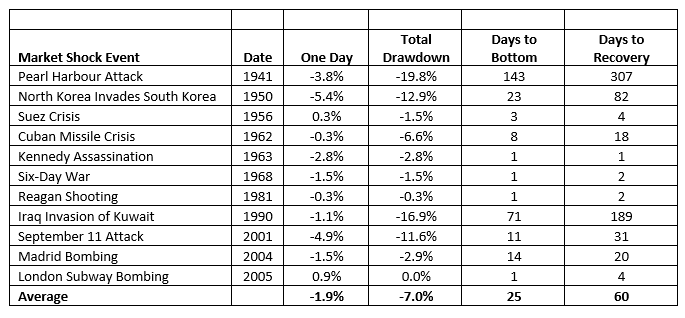

After a pretty miserable financial year for 2022 in most major equity markets, we can but hope for better in FY 2023. But there is more than hope to justify better expected returns going forward. We have reason to believe that much of the negativity surrounding the Russian invasion of the Ukraine, the supply-chain problems as a result of the pandemic and central bank moves to start the next upward leg in the interest rate cycle have been priced in. Markets often react quickly (and ask questions later) when anticipating the impact of such outside events.

While we do not pretend to know how or when the Russian invasion of Ukraine and the supply-chain problems will be fixed, markets have had a good six months to ponder and act. On the other hand, the turnaround in central bank activity in June warrants far deeper scrutiny.

All well-trained economists know that hiking interest rates does nothing to cure the supply issues created by the Covid lockdowns and exacerbated by the Ukraine invasion. Central bankers, including Jerome Powell from the US Federal Reserve (“Fed”) and Dr Philip Lowe from the Reserve Bank of Australia (“RBA”) repeatedly said as much over the first five months of 2022.

It seems one bad inflation print at the start of June in the US caused the “play book” to be thrown out of the window. Suddenly there was a groundswell of support for central banks to say that they can cure the whole inflation problem using aggressive interest rate hiking. That’s not possible!

Economics didn’t change overnight! We just think the central bankers lost their collective nerve. Or perhaps they are trying to jawbone down inflation expectations in current wage negotiations.

Two things are certainly true. Inflation hurts consumers no matter what the source: demand or supply. The drivers of current global inflation include components from both supply-side shocks and demand-side pressures.

One of many complicating factors is that the massive increases in energy costs and grain prices emanating from the Ukraine invasion not only directly affect, say, petrol and food prices, there is also a secondary source of inflation created as the primary sources infect related industries – such as travel and hospitality.

While some central banks attempt to strip out the primary sources of inflation in food and energy prices to produce so-called ‘core’ or ‘trimmed-mean’ inflation measures, they are unable to strip out the secondary effects.

So, the big question is, are central bankers just saying what they think we want to hear or have they lost the plot? If they are playing mind games and plan only to take rates up to just above ‘neutral’, where monetary policy is neither expansionary or contractionary (2% to 3%), we’re probably all fine. If they want to push rates up until inflation comes down (because the supply side causes will not) then we could have a recession to contend with. The ball is in their court.

Recent data suggest that inflation might be near a peak and so some welcome signs could be just around the corner. Indeed, at the very end of June, the Fed’s preferred core PCE measure came in at only 0.3% for the month and 4.7% for the year – which beat expectations and was down 0.2% from the previous reading.

Whatever central bankers are really thinking, the Fed made a massive 0.75% increase to its cash rate, the RBA increased our cash rate by 0.5% and the Bank of England made its fifth successive monthly increase – all in June. The European Central Bank (“ECB”) ended its bond buying program and called for a 0.5% increase in its prime interest rate.

At first, the yields on long dated bonds reacted strongly upwards making equities seem less attractive – particularly the high growth stocks e.g. technology companies. The S&P 500 experienced its worst week since 2020 in mid-June but then the market recovered all of these losses and more in the following week. As is usual, most developed markets followed suit. In the final week of June, markets were a little choppy but largely held on to their previous week’s recovery.

Since company earnings’ forecasts (from the Refinitiv broker-based surveys) are holding up quite well we have good reason to suspect some markets are under-priced and underlying growth is strong. However, that does not translate into deciding that now is a good time to buy. Prudent investing is far more complicated than that.

It is difficult to impossible to assess what Russia is doing or trying to achieve in the Ukraine conflict. But Russia is clearly struggling in the economic war. The G-7 countries just agreed on banning imports of gold from Russia, which somewhat further stifles its ability to fund further offensives.

Russia just defaulted on government bonds for the first time since 1918 – a year after the Russian revolution and amid the start of the Spanish flu pandemic. The two euro-based bonds that defaulted amounted to $US 57bn. Defaults affect credit ratings and the cost of further borrowings.

And NATO has now decided to put 300,000 extra troops on high alert to be deployed on the eastern front of Europe. There are currently eight centres of mobilisation in that region and the extra troops on standby will effectively increase the troops size by about 10-fold! NATO will be organising battalion-sized groups of 3,000 to 5,000 troops and supplying them with all manner of weaponry and cyber-security. And Turkey’s veto has been lifted, enabling Norway and Sweden to join NATO.

While parts of the world are in turmoil, Australia GDP growth came in at an impressive 0.8% for the quarter and the unemployment rate stayed at an historic low of 3.9%. Even retail sales popped up at 0.9% but some of that monthly gain is due to increased prices as the statistic is not adjusted for inflation.

On the back of the RBA interest rate hike, the CBA revised its forecast for house prices. It now expects a fall of 11% this year and a further 7% next year – down from a 3% fall this year just prior to the RBA interest rate decision. However, those new forecasts are greatly at odds with their forecasts for Australian economic growth. CBA expects growth to be over 2% next year from 3.5% this year. A house price crash and strong economic growth are implausible to us. House prices have softened a little but there currently seems to be little evidence to suggest a price crash is looming – at least not yet.

Many home owners are on fixed-rate home loans and so many will not yet experience any increase in that part of their mortgage payments; some have ‘slack’ in their payment plans to absorb the first few hikes; and the supply of housing still does not seem to be keeping pace with demand. It should be emphasised that the current RBA interest rate of 0.85% is less than it was in October 2019! The first part of the hiking cycle is to remove the emergency rates that were put in place to address the onset of the Covid pandemic. The economy does not now need emergency settings but during the onset of the pandemic, it seems to have been an excellent call by the RBA and, indeed, the federal and state governments!

Going forward, the key dates for monitoring the state of the global economy are July 13th and 27th. The former is the expected date for the next US CPI data release; the latter is the date of the next Fed meeting on rates.

The market is still predicting a 0.75% hike by the Fed in July but the odds have softened somewhat. There is now over a 16% chance of only a 0.5% hike in July.

Asset Classes

Australian Equities

The ASX 200 had a bad month ( 8.9%) and financial year ( 10.2%). Notwithstanding, the expected dividend yield for FY23 is 4.6% (Refinitiv).

Over FY22, Energy (+24.5%) and Utilities (+29.3%) performed particularly well; Telcos were comfortably positive (+4.3%). IT was the spectacular loser ( 38.7%).

International Equities

The S&P 500 also had a bad June ( 8.4%) but the Shanghai Composite, by comparison, actually did quite well (+6.7%).Over FY22, the London FTSE (+1.9%) was just above water. Most of the other major markets lost between about 5% and 20% over FY22. The S&P 500 had its worst first half year since 1970.

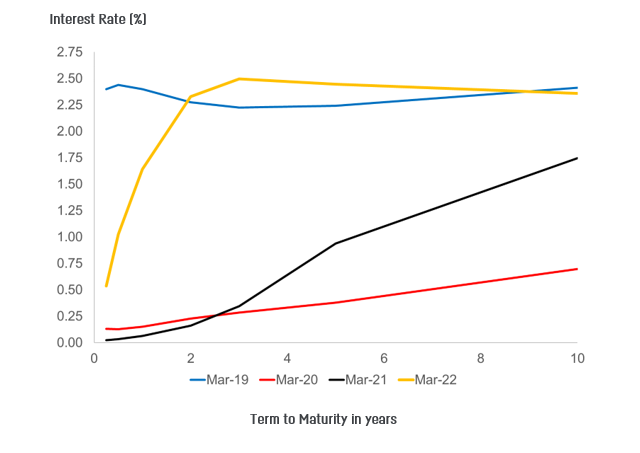

Bonds and Interest Rates

The RBA lifted its overnight cash borrowing rate from 0.35% to 0.85% at its meeting in early June. Most market analysts seemed to have been expecting a ‘typical’ 0.25% increase or perhaps 0.4% to restore the historical scale of one which climbs in 0.25% increments. This surprise 0.50% increase did not seem to achieve any positive results and, indeed, reflected poorly on the RBA after all of the statements made by the bank in prior months.

The Fed, after saying at its previous meeting that it wouldn’t do more than a 0.5% hike, not only increased the Fed funds rate by 0.75% but flagged such an increase would also be considered at its July meeting.

The expected Fed rate at the end of calendar 2022 is now 3.4% which, in itself, cannot be considered high. 3.4% is about 1% over the estimated ‘neutral rate’ but it is much higher than had been expected a few months ago.

The ECB and the Bank of England also joined in the monetary policy aggression. Perhaps central banks feared being the last to hike ‘enough’ and, hence, be criticised if inflation becomes more entrenched than they anticipated.

10-year interest rates on government bonds unsurprisingly went through gyrations following these early June interest rate moves by central banks. It seems to be the consensus view that the long-bond yields caused the major volatility in equity markets.

Other Assets

Iron ore and copper prices retreated even further in June – each by falling by over 10% – putting them both into bear market territory having fallen by more than 20% from recent peaks. However, iron ore prices are still well above $100 / tonne.

Oil prices also slipped in June but not as much as the metals. Gold prices were stable but the Australian dollar was down 4.1% over June.

There have been many casualties in the crypto currency space.

Regional Review

Australia

Economic growth in the March quarter was strong at 0.8% or 3.3% for the year. Importantly, the household savings ratio fell to 11.4% after having been above 20% just a few quarters before. Households stored cash in the pandemic – either by choice or lack of options to spend – and this leaching back into the economy is supporting growth prospects. With a ‘normal’ savings ratio of around 7% just before the onset of the pandemic, there is room for further cash injections into consumer spending.

There were 60,600 new jobs reported for the month. This total included 69,400 new full-time jobs accompanied by a small loss in part-time jobs. The unemployment rate was steady at 3.9%.

We have also experienced an additional driver of inflation in Australia. Owing to the floods and frosts at the beginning of winter, and a shortage of seasonal workers, the prices of some produce – such as lettuces – have sky-rocketed. Iceberg lettuces have reportedly risen from around $3 – $4 to a peak of $12 a head. Presumably the people buying these lettuces didn’t first check the price!

Since our CPI inflation is well below that in many developed nations, and we have a large savings buffer, it is difficult to see the Australian economy struggling in the remainder of 2022. What happens in 2023 will depend to a large extent on the wage negotiations that are now underway. Workers have a reasonable expectation of maintaining real (or inflation-adjusted) wages but if the current round of wage negotiations, then gets baked into inflation expectations as in the 1970s and 1980s, we could have a longer-term economic problem with inflation. It took a major recession in 1990-1991 to put the inflation genie back in the bottle.

China

China continues to grapple with its zero Covid policy. While large numbers of people – even in Shanghai – are fully vaccinated, there are tens of millions of old people who are not.

There was some mild evidence of the Chinese economy bouncing back after the lockdown ended. However, a US-based ‘beige book’ survey rejects that notion.

Chinese retail sales came in at 6.7%, industrial production at +0.7% and fixed asset investment at +6.2%. While these statistics are poor on face value, they did beat expectations. The full effects of China’s new stimulus packages have not yet been felt to any great extent.

US

There were 390,000 new jobs created as reported in the latest monthly labour report and the unemployment rate remains at 3.6%. Since only 328,000 new jobs had been expected, the report card was seen as a positive.

Wage growth at 5.2% was far behind CPI inflation which came in at 8.6% for the year or 1.0% for the month. The core CPI inflation rates that strip out energy and price inflation came in at 6.0% for the year and 0.6% for the month. The 8.6% print was the biggest since 1981.

The University of Michigan consumer sentiment index came in at an historic low of 50 but there was a glimmer of hope on the expected inflation front i.e that it is beginning to soften.

The headline PCE measure of inflation came in at 6.3% for the year and 0.6% for the month. The core variant came in at 4.7% for the year an 0.3% for the month. The expected annual core reading was 4.8% and the pervious read was 4.9%.

The Atlanta Fed, which has a strong reputation for its forecasting ability, is predicting growth of 0.9% (annualised) for the June quarter but that is down from the 1.3% forecast made two weeks before. Since the previous growth read was 1.5% for the March quarter, two consecutive negative quarters (a technical recession) might be avoided but the Fed and many of the regional bank presidents continue to call for major increases in interest rates.

The noted Wharton School professor, Jeremy Siegel,recently said that the US might already be in a recession. He also noted that inflation might be cooling and he thinks the US stock markets are not overvalued.

The Fed’s own ‘dot plots’, which records present Fed members’ individual predictions for the cash rate, show that the consensus is pointing to the cash rate declining in 2024 following substantial increases in 2022 and a flattening in 2023. That might be enough to dodge the recession bullet.

Europe

The ECB has, at last, joined the monetary policy move to end the accommodative regime that has lasted for a very long time. Interestingly, it has been reported that the UK, which left the EU in “Brexit”, is performing similarly to continental Europe.

With Sweden and Norway close to joining NATO and NATO moves to increase troops and armaments in the region, Russian President Putin is not left with many options for success in Ukraine.

Rest of the world

The World Bank is predicting global growth to be 2.9% in 2022. Emerging markets growth usually keeps that growth forecast quite a bit higher. It will be interesting to see if NATOs push to improve the military support to Ukraine has any spill-over to the private sector economy.